A select few businesses have a value of $1 trillion or higher. Apple, Saudi Aramco, Microsoft, Google parent Alphabet, and Amazon are all on the list. The Adani Group, led by India’s and the world’s fourth-richest man Gautam Adani, wants to join their ranks.

Aiming for Trillion Dollars

The Adani Group has risen rapidly in recent years, both in terms of market value and presence across numerous industries, including mining, electricity, infrastructure, logistics, and more.

Based on the sources, Jugeshinder ‘Robbie’ Singh, chief financial officer, of Adani Group said that if they had assets and businesses of such nature, given the mix of companies they possessed, which might result in becoming a $1 trillion group.

The worth of Adani Group has increased by more than 16 times in just seven years, from $16 billion in 2015 to $260 billion in 2022. The company may need some time to move from $260 billion to $1 trillion, though. The sources go into detail on what it takes to build a firm worth a trillion dollars and how long it took for these businesses to surpass the $250 billion- and trillion-dollar valuation thresholds.

Reaching the 1st Milestone

It might be argued that building a business from nothing and reaching the $250 billion mark are difficult tasks. For Apple, Google, Microsoft, and Amazon, it took an average of more than 16 years from the date of their initial public offering for their market capitalization to reach $250 billion.

Apple required the most time, 30 years. Before the dot com catastrophe in 1998, Microsoft was the first company to reach a market capitalization of $250 billion. Contrarily, the Adani Group needed 28 years from the time of the listing of Adani Enterprises in 1994 until 2022 to surpass a cumulative market valuation of $250 billion.

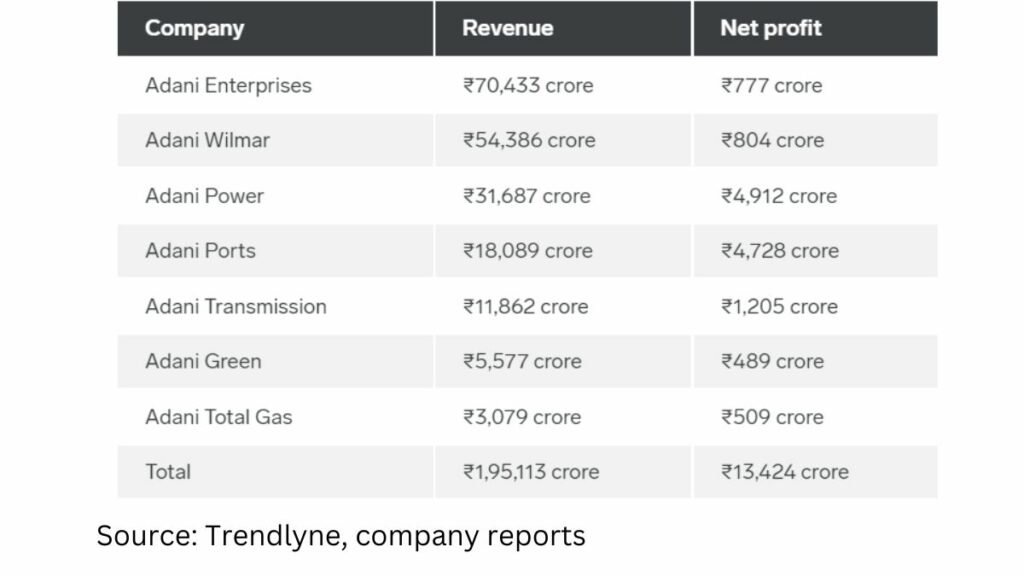

The Adani Group now consists of seven businesses; each of these businesses was listed at a different period, with Adani Wilmar being the most recent to do so this year.

About the $1 Trillion Behemoths

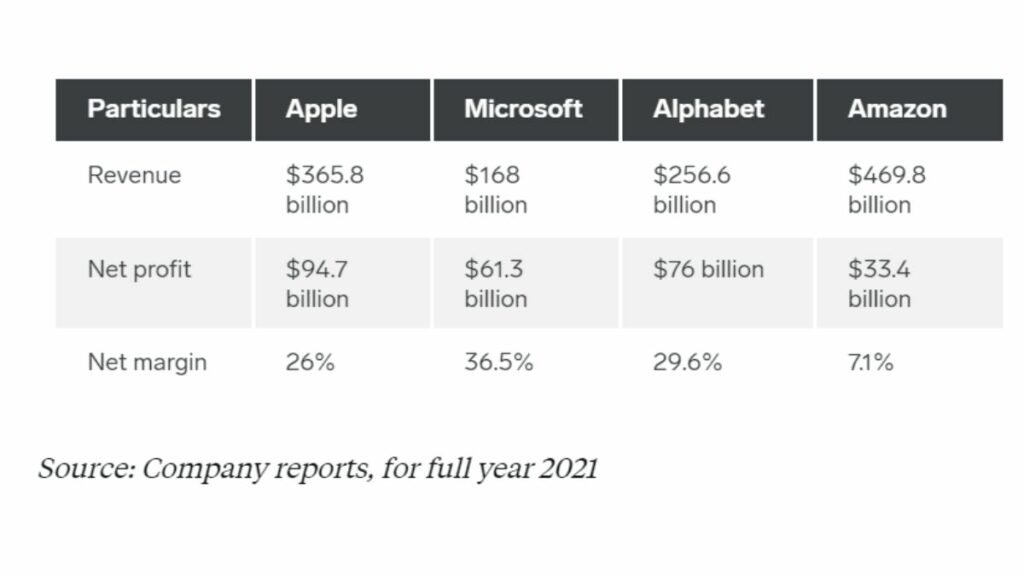

Apple and Amazon reached the $1 trillion market cap quite quickly after going from a $250 billion market cap, whereas Google and Microsoft took much longer. Apple, Microsoft, Alphabet, and Amazon are all trillion-dollar firms for a reason; in 2021, each of the four businesses generated hundreds of billions of dollars in revenue.

Amazon, which had the lowest profits but the biggest revenue, yet managed to generate over $33 billion in net income or more than 19 times the earnings of the Adani Group in FY22.

In contrast, the Adani Group reported total revenues of $24.4 billion and a net profit of $1.7 billion in FY22.

Read More: All the Top 10 Best Technologically Advanced Cities in India