India’s edtech sector is witnessing one of its biggest consolidation moves as Ronnie Screwvala’s upGrad enters advanced talks to acquire Unacademy in a deal valued between $300-400 million. Sources suggest the transaction could finalize within three weeks, marking a dramatic shift in the post-pandemic online education landscape.

UpGrad-Unacademy Deal Structure at a Glance

| Parameter | Details |

|---|---|

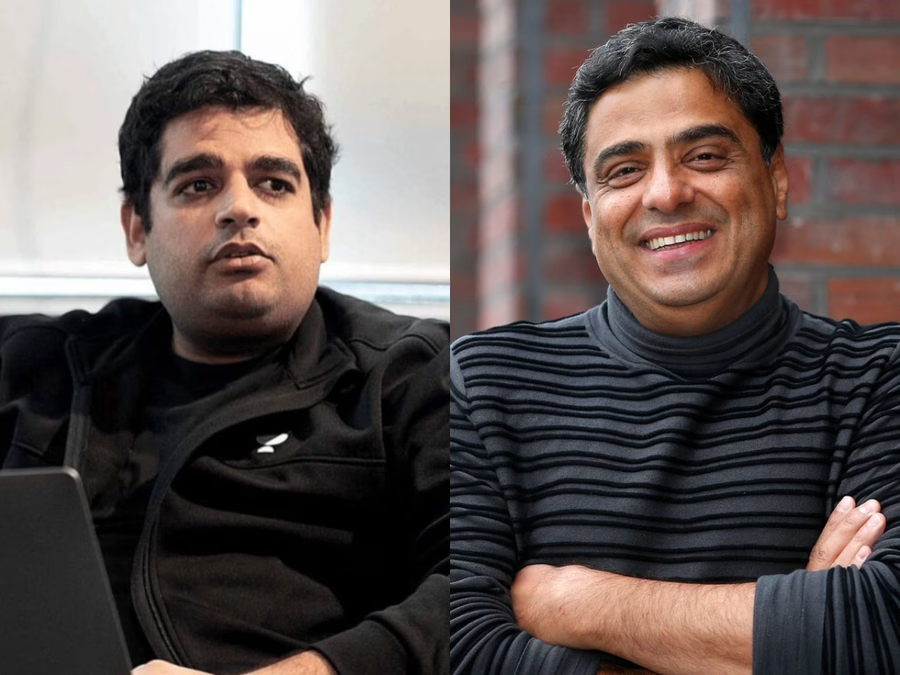

| Buyer | upGrad (Founded by Ronnie Screwvala, Mayank Kumar, Phalgun Komandur) |

| Target | Unacademy (Founded by Gaurav Munjal, Roman Saini, Hemesh Singh) |

| Deal Value | $300-400 Million (~₹2,800-3,500 Crore) |

| Previous Valuation | $3.44 Billion (2021) – 88% drop |

| Transaction Type | Complete share-swap (no cash component) |

| AirLearn Status | Spun off as separate entity (no upGrad equity) |

| Timeline | Term sheet expected within 3 weeks |

| Unacademy Cash Reserves | ₹1,200 Crore |

| Annual Cash Burn | Reduced from ₹1,000 Cr to ₹100 Cr |

| upGrad Valuation | $2.25 Billion (2024) |

The Strategic Rationale Behind This Blockbuster Deal

For upGrad, which dominates higher education and professional skilling, this acquisition represents expansion into competitive exams and K-12 segments through Unacademy’s extensive offline centres in Kota, Delhi, and other key cities. The move aligns perfectly with upGrad’s reported plans for an IPO in coming quarters.

Unacademy’s impressive turnaround story—reducing annual cash burn from over ₹1,000 crore to approximately ₹100 crore while maintaining ₹1,200 crore in cash reserves—makes it an attractive acquisition target. This financial discipline demonstrates operational maturity rare in the edtech space.

AirLearn: The Independent Venture

Under the proposed structure, Unacademy’s AI-powered language-learning app AirLearn will be carved out as a separate entity, with upGrad holding no equity stake. Founders Gaurav Munjal and Roman Saini will lead AirLearn as an independent venture, while co-founder Sumit Jain, who joined through the CommonFloor acquisition, now heads the test-prep division.

This strategic separation allows founders to pursue innovative AI-driven education while ensuring the core test-prep business integrates seamlessly with upGrad’s ecosystem.

Understanding the Valuation Drop

The staggering 88% valuation decline from $3.44 billion reflects broader corrections across India’s edtech sector post-pandemic. As students returned to offline classrooms in 2022, online platforms faced revenue pressures, forcing aggressive cost-cutting and business model pivots.

In FY24, Unacademy reported ₹839 crore in revenue, down 7% year-on-year, though net losses narrowed by an impressive 62% to ₹631 crore, showcasing improved unit economics despite revenue headwinds.

For comprehensive startup analysis and tech trends, visit TechnoSports Business.

What This Means for Indian Edtech

This consolidation signals maturity in India’s edtech ecosystem. The sector experienced tremendous boom during the pandemic but has faced significant challenges since 2022. With PhysicsWallah—Unacademy’s direct competitor—recently going public at $2.25 billion valuation, the race for market dominance intensifies.

The combined entity creates a full-stack learning platform spanning higher education (upGrad’s strength), professional skilling, test preparation, and offline coaching centers—positioning it as India’s most comprehensive edtech solution.

Market Impact and Competition

The all-stock transaction adds approximately $100 million to upGrad’s revenue while providing access to Unacademy’s user base and brand equity. Backed by marquee investors including General Atlantic, SoftBank, and Temasek, Unacademy brings credibility and established market presence.

For the latest updates on mergers and acquisitions, check TechnoSports Technology.

Learn more about upGrad’s journey at their official website and Unacademy’s evolution at their platform.

Frequently Asked Questions

Q1: Why is Unacademy’s valuation so much lower than its 2021 peak?

Unacademy’s valuation dropped from $3.44 billion (2021) to $300-400 million due to post-pandemic corrections in the edtech sector. As students returned to offline learning in 2022, online platforms experienced declining enrollments and revenue pressures. The broader market correction reflects realistic assessments of sustainable growth rates versus pandemic-era euphoria. However, Unacademy’s improved cash burn metrics and operational efficiency demonstrate a healthier, more sustainable business model.

Q2: What happens to Unacademy employees and educators after the acquisition?

While official employee transition plans haven’t been disclosed, upGrad typically retains talent during acquisitions to maintain operational continuity and brand value. The appointment of Sumit Jain as CEO of the test-prep division signals leadership continuity. However, integration challenges remain, particularly retaining Unacademy’s star educators who are crucial to student engagement and revenue. The success of this merger largely depends on managing talent retention effectively during the transition period.