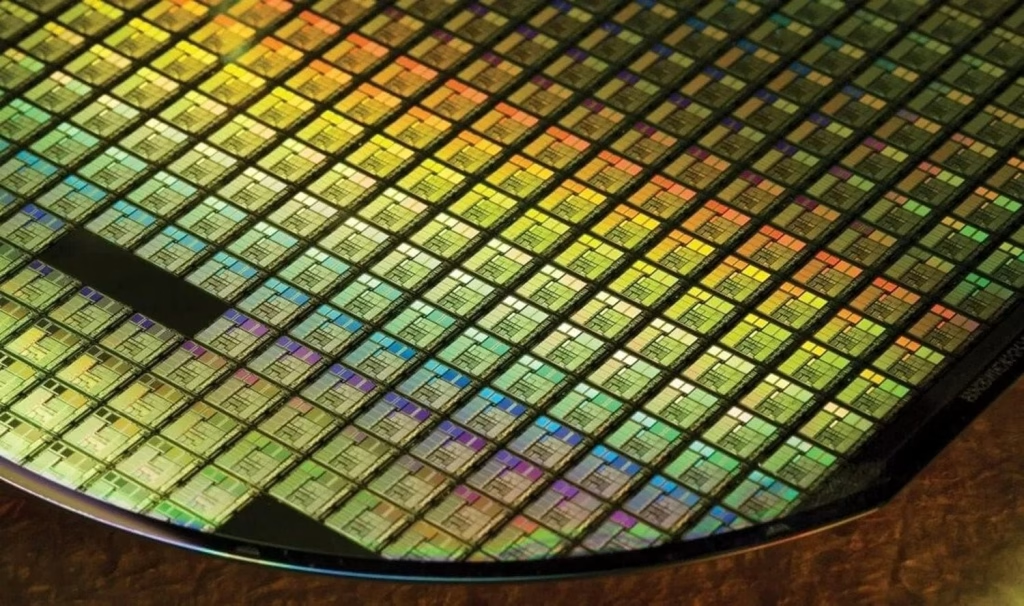

TSMC, the world’s largest chip manufacturer, will implement price increases of 5-10% on advanced semiconductor processes starting in 2026. The price hikes will affect 5nm, 4nm, 3nm, and the upcoming 2nm manufacturing nodes, impacting major tech giants including Apple, NVIDIA, AMD, and Qualcomm. Here’s what this means for the semiconductor industry and consumer electronics.

Price Increase Breakdown

| Process Node | Price Increase | Application | Current Wafer Cost |

|---|---|---|---|

| 2nm | Up to 10% | AI, HPC | $30,000 |

| 3nm | 5-10% | Flagship mobile | $18,000-$20,000 |

| 4nm/5nm | 5-10% | Mid-range chips | $18,000 |

| Smartphone chips | ~5% | Mobile devices | Varies |

| CPU chips | ~7% | Desktop/laptop | Varies |

| AI chips | ~10% | Data centers | Varies |

Reasons Behind the Price Hike

TSMC cited rising US tariffs, supply chain pressures, and currency fluctuations as main reasons for the planned increases. The foundry’s capital expenditures are driven by expansion of advanced manufacturing capacities in the U.S. and Taiwan, with the company needing to keep margin targets on track. Chip production at TSMC’s Fab 21 in Arizona already costs approximately 15% more compared to Taiwan fabs, and AMD CEO Lisa Su confirmed U.S. production costs run 5-20% higher.

Impact on Major Customers

TSMC reported 100% utilization of all advanced chip processes, including 3nm and 5nm, creating a production bottleneck. High-performance computing customers are accounting for a larger portion of orders, traditionally dominated by the mobile segment. Apple, which historically received preferential pricing, will likely face these adjustments alongside other clients. NVIDIA’s AI chip demand continues driving capacity constraints, while Qualcomm and MediaTek face margin pressures that could translate to higher smartphone prices.

Four-Year Price Strategy

TSMC introduced a rare multi-year price increase strategy, implementing consecutive annual hikes over four years for advanced nodes. This marks a significant shift from traditional pricing approaches and reflects the astronomical costs of building next-generation fabrication facilities. N2/N2P/A16-capable fabs are more expensive than N3-capable fabs, requiring increased capital expenditures beyond the current $38-42 billion annual spending.

Limited Competition Benefits TSMC

TSMC’s 3nm and 4nm/5nm technologies have no competition from Intel Foundry and limited competition from Samsung Foundry. With 2nm-class nodes, TSMC will feel comfortable for at least a couple of years as the technology provides significant performance, power, and area improvements. This dominant market position allows TSMC to implement price increases with minimal customer pushback.

Consumer Impact Expected

The price increases will affect flagship smartphones, laptops, gaming GPUs, and AI servers starting in 2026. Android flagship phones from Samsung, Xiaomi, and OPPO using Qualcomm or MediaTek chips will see price increases. Apple’s iPhone 18 series and MacBooks with M5 chips will also reflect higher manufacturing costs, though Apple’s margins may absorb some impact.

Older Nodes May See Discounts

While advanced nodes become pricier, TSMC may offer discounts on mature processes like 28nm and above. This strategy supports demand in automotive, IoT, and general electronics sectors where cutting-edge nodes aren’t necessary.

For official updates, visit TSMC’s investor relations page. Stay updated with semiconductor industry news on Tech2Sports for detailed analysis.

FAQs

Which chips will be most affected by TSMC’s price increase?

AI accelerators and high-performance computing chips see the largest 10% increase, followed by CPUs at 7% and smartphone chips at 5%.

Will consumer device prices increase in 2026?

Yes, flagship smartphones, laptops, and gaming hardware will likely see price increases as manufacturers pass on higher chip costs.