Market research reports have confirmed that the global wafer market foundry size will be US 82 billion in 2020, having TSMC of 55% global market share, and Samsung has taken 15%. In this, TSMC overall took 85% in comparison with Samsung that is just less than 5%. The profit of TMC in comparison with Samsung is 17 times more. These two semiconductor giant company is just competing to another level.

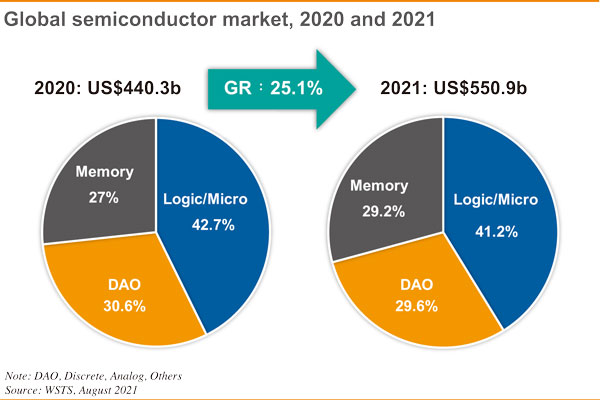

The statistics of WSTS shows the market size of the global semiconductor was just US$440.3 billion in 2020, and it is expected to grow by 25.1% to US$550.9 billion in 2021, this global semiconductor market will proceed to the US$500 billion mark. In this, the memory sector will go to US$162.11 billion in 2021, to 37.1% from 2020. It is literally very good news for Samsung that has a total 40% global market share.

In the total revenue of Samsung in 2020, 30.8% had been contributed by semiconductors that have been accounted for 52.2% of the profit. It has been estimated for 55% of its 2021 revenue will form semiconductors. It is also reported that TSMC has also made a high wall, but South Korea is not ready to defeat and hoping for market leadership.

We can also analyze such competitive advantages and disadvantages of wafer foundry from node process technology, ecosystem, and also such customer structure. It is reported that this node process technology has been hardly driven to 28nm, like the copper interconnection process, low dielectric insulators. In this Samsung has developed such FD-SOI process for the different from TSMC’s FinFET. The entering of 7nm has also put such pressure on both the materials and also such structure innovation.

In this new time of GAAFTE has requires such materials innovations containing such application of new materials like boron nitride and transition metal disulphur compounds. The timeline has been disclosed by Samsung, in this Samsung also will overtake TSMC in GAAFTE.

Samsung starts to process technology refining to surpass TSMC, it will address the issues like equipment investment, customer support, and also such ecosystem practices. It is true nowadays the competition in these hot markets has not meant the gameplay. The customer has ordered billions of dollars set the nerve on the edge. This Taiwan and South Korea also have their own disadvantages.

A big thanks for the source.