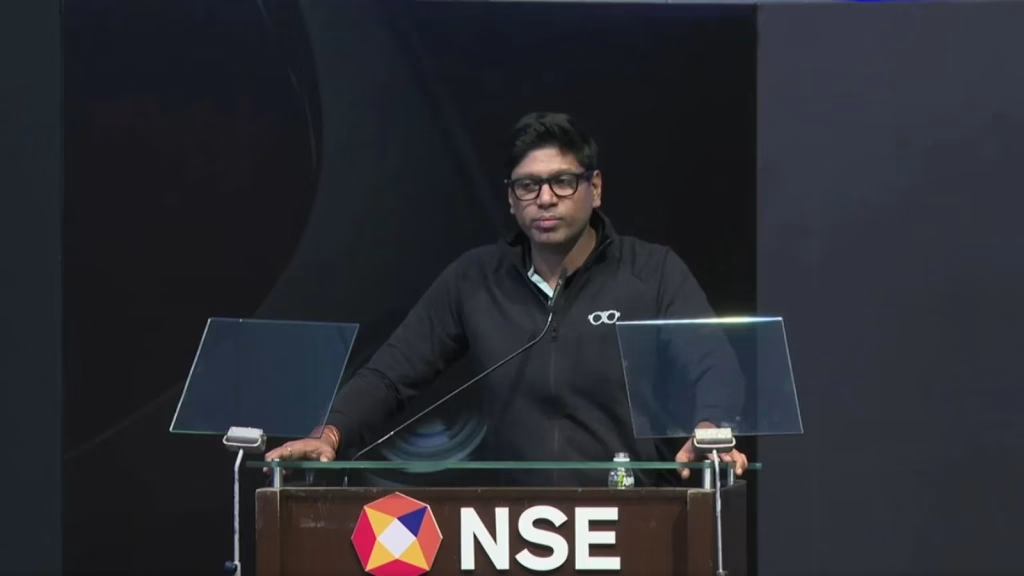

Peyush Bansal’s eyewear empire Lenskart Solutions made its stock market debut today with a whimper rather than a bang. Despite receiving overwhelming investor interest during subscription, the shares listed at a disappointing discount on both NSE and BSE, catching many retail investors off-guard.

Listing Day Performance: The Numbers

Lenskart shares opened at ₹395 on NSE (1.74% discount) and ₹390 on BSE (2.99% discount) against the issue price of ₹402. However, the stock showed resilience during trading hours, recovering past its IPO price to trade 3.79% higher at ₹404.80 on BSE.

| Metric | NSE | BSE |

|---|---|---|

| Issue Price | ₹402 | ₹402 |

| Opening Price | ₹395 (-1.74%) | ₹390 (-2.99%) |

| Intraday High | ₹409.90 | ₹409 |

| Intraday Low | ₹356.10 | ₹355.70 |

| Market Cap | ₹70,348 Cr | ₹70,227 Cr |

IPO Details: Record-Breaking Subscription

The ₹7,278 crore IPO was open for subscription from October 31 to November 4, 2025, receiving massive investor interest with 28.26x oversubscription. QIBs led the charge with 40.35x subscription, followed by NIIs at 18.23x and retail investors at 7.54x.

The issue comprised a fresh issuance of ₹2,150 crore and an offer for sale of ₹5,128.02 crore, with promoters and marquee investors offloading their stakes.

Why the Tepid Listing?

Market analysts point to several factors behind the underwhelming debut:

Valuation Concerns: Despite strong brand visibility, concerns around high valuation and competitive intensity weighed on short-term sentiment.

Grey Market Premium Drop: GMP started strong at ₹70 before IPO opening, jumped to ₹95 on Day 1, but fell to ₹39 by final subscription day, indicating cooling investor expectations.

Market Sentiment: The broader market conditions and recent tech stock corrections may have impacted pricing dynamics.

For those tracking IPO investments, Lenskart’s performance highlights the importance of timing and valuation.

Company Fundamentals: A Different Story

Established in 2008, Lenskart is a technology-focused eyewear company involved in design, manufacturing, branding, and retail of prescription eyeglasses, sunglasses, and contact lenses.

Financial performance shows impressive growth: Revenue increased from ₹5,609.87 crores in 2024 to ₹7,009.28 crores in 2025, while the company turned profitable with ₹297.34 crores profit in 2025 against a loss of ₹10.15 crores in 2024.

Expert Recommendations

Market experts suggest allotted investors can consider holding shares for medium to long term, supported by earnings visibility and expanding store footprint, with a stop loss around ₹350.

The company’s strengths lie in its vertically integrated model, in-house manufacturing, aggressive store expansion, and data-driven supply chain.

What’s Next?

Lenskart announced plans to open its upcoming AI-enabled smartglasses, B by Lenskart, for India’s developer community by December 2025, signaling continued innovation.

Looking for more insights on market trends? Check out our latest technology and finance updates for comprehensive coverage.

FAQs

Q1: Should I hold or sell Lenskart shares after listing?

A: Market experts recommend holding for long-term investors given Lenskart’s strong fundamentals, market leadership, and expansion plans. The company turned profitable in FY25 with ₹297 crores profit and showed 25% revenue growth. However, short-term traders may consider exiting with a stop loss at ₹350 due to valuation concerns and market volatility.